Algorithmic Trading Market Analysis: Strategies and Technologies Shaping the Future 2028

Algorithmic Trading Market Forecast

The global algorithmic trading market is expected to be driven by a rise in demand for a reduction in transaction costs.

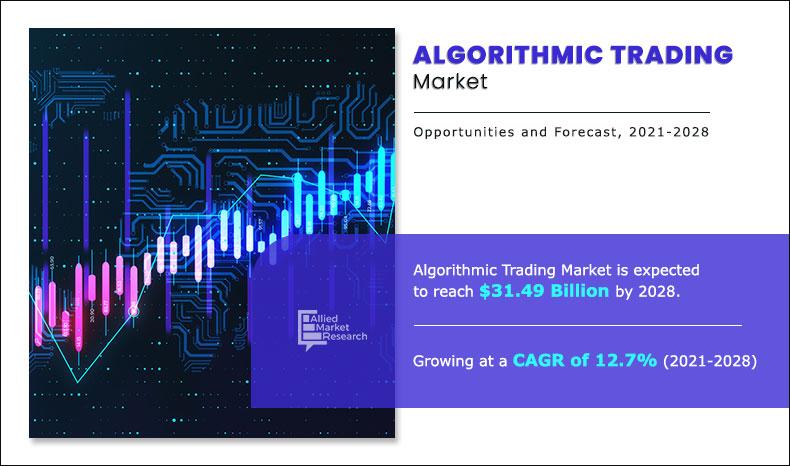

PORTLAND, PORTLAND, OR, UNITED STATES, May 23, 2024 /EINPresswire.com/ -- According to a recent report published by Allied Market Research, titled, “Algorithmic Trading Market by Component, Type, Deployment Mode, Type of Traders, and Region: Global Opportunity Analysis and Industry Forecast, 2021-2028,” the global algorithmic trading market size was valued at $12,143 million in 2020, and is projected to reach $31,494 million by 2028, registering a CAGR of 12.7% from 2021 to 2028.

Algorithmic trading, also known as algo trading, refers to the use of computer algorithms to automate the process of buying and selling financial instruments in the market. These algorithms are designed to follow specific sets of rules and criteria, such as timing, price, quantity, or any mathematical model, to execute trades at speeds and frequencies that would be impossible for a human trader.

Request Sample Report at: https://www.alliedmarketresearch.com/request-sample/A08567

The growth of the global algorithmic trading market is mainly driven by factors such as rise in demand for reliable, fast, and effective order execution; the emergence of favorable government regulations; and the need for market surveillance. In addition, rise in demand for reducing transaction costs fuels the demand for algorithmic trading. However, insufficient risk valuation capabilities may hamper the market growth to some extent.

On the other hand, emergence of AI and algorithms in financial services is expected to provide lucrative opportunities for market growth during the forecast period. In addition, rise in demand for cloud-based solutions is anticipated to be opportunistic for the market growth during the forecast period.

In 2020, the solution segment exhibited the highest growth in the algorithmic trading market share, and is expected to maintain its dominance in the upcoming years, as the algorithmic trading solutions provides several benefits such as reduced transaction costs due to lack of human intervention and instant and accurate trade order placement. In addition, the market players are introducing advanced algorithmic trading solutions to serve the various needs of their customers.

For Report Customization: https://www.alliedmarketresearch.com/request-for-customization/A08567

For instance, in September 2019, BNP Paribas introduced an upgraded FX trading platform with real-time analytics and interactive algorithms. However, the services segment is expected to witness the highest growth, due to the extensive adoption of professional services among end users, as it ensures effective functioning of algorithmic trading solution throughout the process.

By type, the global algorithmic trading market share was dominated by the stock markets segment in 2020, and is expected to maintain its dominance in the upcoming years, due to increase in adoption of algorithmic trading solutions by investors to trade stocks as it operates through a computer program without a need for human interventions. However, the cryptocurrencies segment is expected to witness the highest growth, owing to rise in interest of trading professionals toward crypto-currency trading.

Based on components, the solution segment generated the maximum revenue in 2020, with around two-thirds of the total market share and is predicted to continue its dominance during the 2021-2028 period. On the other hand, the services segment is expected to have the highest CAGR of 13.8% during the same period.

Based on region, the North America algorithmic trading market accounted for the highest market share in 2020 with around two-fifths of the total revenue and is expected to maintain its leadership status by 2028. However, the market in Asia-Pacific is expected to have the fastest CAGR of 15.3% during the analysis timeframe.

Buy Now & Get Exclusive Report at: https://www.alliedmarketresearch.com/algorithmic-trading-market/purchase-options

The current estimation of 2028 is projected to be higher than pre-COVID-19 estimates. The COVID-19 outbreak has low impact on the growth of the algorithmic trading industry, as the algorithmic trading adoption have increased in the face of unprecedented circumstances. For instance, Reserve Bank of Australia, in its recent publication stated that the COVID-19 pandemic may have only furthered the industry's shift toward electronic trading.

In addition, the market players have introduced innovative algorithmic trading products during the pandemic to ensure better serving the increased volumes of trading. This factor drives the algorithmic trading market growth. For instance, in March 2021, Cowen, an American multinational independent investment bank and financial services company launched an algorithmic trading solution to help institutional clients navigate market dynamics caused by increased volumes of retail trading.

Some of the key algorithmic trading industry players profiled in the report include 63MOONS, Virtu Financial, Software AG, Refinitiv Ltd. MetaQuotes Software Corp. Symphony Fintech Solutions Pvt Ltd. Argo SE, Tata Consultancy Services, Algo Trader AG, and Tethys. This study includes algorithmic trading market trends, algorithmic trading market analysis, and future estimations to determine the imminent investment pockets.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A08567

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

If you have special requirements, please tell us, and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients’ requirements is complemented with analyst support and customization requests.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

David Correa

Allied Market Research

+ 18007925285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.